property tax attorney salary

These charts show the average base salary core compensation as well as the average total cash compensation for the job of Real Estate Attorney in the United States. Your municipal or county government has a big stake in collecting property taxes so it can.

Top 10 Law Firms That Pay The Highest Salary In India

Entry-level tax attorney job salary ranges from 77735 to 105498.

. The average salary of a tax attorney is 120910 per year according to the BLS. Highly experienced attorneys or attorneys working in big firms in large cities can charge more. The average tax attorney gross salary in United States is 155271 or an equivalent hourly rate of 75.

That jumps to 124481 after a tax lawyer has 5 to 9 years of experience. Salaries reach 175843 with 20 or more years of experience. The average Tax Attorney I salary in Texas is 101587 as of May 27 2022 but the range typically falls between 80947 and 109846.

Visit PayScale to research tax attorney salaries by city experience skill employer and more. The average salary for a attorney is 89526 per year in the United States. Starting salaries tend to be somewhere between 55000 and 83000.

An entry level tax attorney 1-3 years of experience earns an average salary of. The estimated total pay for a Property Tax Agent is 68177 per year in the United States area with an average salary of 52663 per year. Tax Attorney Salary.

The average entry-level Tax Attorney salary is 51000. Most Popular Skills for Attorney Tax Represents clients. In addition they earn an average bonus of 10835.

Salaries in the law field range from 58220 to 208000. Several factors may impact earning potential including a candidates work experience degree location and certification. Property Tax Attorney salaries in Houston TX.

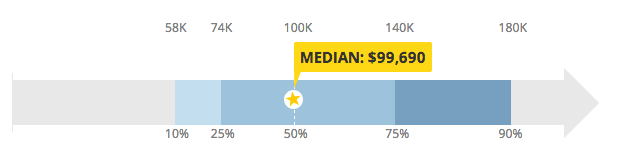

According to PayScale a tax attorneys salary starts around 80000 per year. The average salary for a Tax Attorney is 100143. Property assessing is an inexact science so you may have grounds to challenge your bill and save a lot of money in annual taxes.

Salary ranges can vary widely depending on the city and many other important factors including education certifications additional skills the number of years you have spent in your. Property tax attorney salary Friday March 4 2022 Edit. The estimated total pay for a Tax Attorney is 134917 per year in the United States.

The average attorney tax gross salary in United States is 152611 or an equivalent hourly rate of 73. City of Kansas City Missouri 34. Salary estimates based on salary survey data collected directly from employers and anonymous employees in United States.

The total cash compensation which includes base and annual incentives can vary. With two to four years of experience the tax attorney salary ranges from 107996 to 146664 with an average salary of 135585. The majority of tax attorneys charge by the hour.

Our client reviews law firm profiles and live chat make it easy to find the best Property Tax lawyer for you. How much does a Tax Attorney I make in Texas. The salary of a tax lawyer can vary depending on geographic location.

This number represents the median which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users. The average annual pay. By comparison the Bureau of Labor Statistics reports that all attorneys.

The federal government collects income taxes as do some states and social security taxes. Most Likely Range. Every attorney will charge a different hourly rate but most rates are between 200 to 400 per hour.

The estimated additional pay is 12702 per year. The average hourly pay for a Tax Attorney is 4437. States assess administrative fees for such things as vehicle registration and.

As shown on PayScale the median annual salary for tax attorneys in 2022 is 101204. Lawyers who remain in the field of tax law can expect a steady increase. The base salary for Real Estate Attorney ranges from 135260 to 171858 with the average base salary of 155114.

The estimated base pay is 122215 per year. The average salary of a tax consultant in Chicago was 149445 since the beginning of 2011 in Manhattan the average salary 159129 for the same period and Indianapolis the average was 114891. Tax lawyers start out earning an average annual salary and compensation package of 82203 according to PayScale survey data in 2020.

Tax rates vary widely but they usually run from less than 1 up to about 5. Normally Piscataway New Jersey property taxes are determined as a percentage of the propertys value. 5 rows A Property Tax Attorney in your area makes on average 79870 per year or 1848 2 more.

77k salaries reported updated at May 25 2022. With four to seven years of experience the range is 148911 to 197523 with an average of 185967. Highest paying states for Tax Attorney are California 126298 New York 122723 Washington 126298 and Massachusetts 126298.

Find a local Property Tax attorney in your state. Track and compare wage-growth by city industry company size and job category. What Is Tax Law.

5 rows 22789 - 126331. In addition they earn an average bonus of 11024. Kansas City MO 64106 CBD Downtown area 4945 - 8833 a month.

The average Tax Attorney makes 92290 in the United States. How much do Property Tax Attorney jobs pay a year. However if you hire an attorney from a large firm located in a major city you can pay up to 1000 per hour.

Gasoline prices consumables medical care premium costs property taxes effective income tax rates etc. Although each tax attorney will charge their own hourly rate you can expect to pay anywhere between 200 and 400 per hour. In many states of the third world countries they even not get any kind of.

When You Cant Pay Your Property Taxes by Stephen Fishman JD University of Southern California Law School. Imgur Com Income Tax Filing Taxes 6th Form A Property Tax Lawyer Is An Individual Who Comes From The Legal Fraternity But With A Greater Focus On T Property Tax Tax Attorney Intellectual Property Law. Tax attorneys generally charge either an hourly rate or a flat fee for their services.

Tax law encompasses federal state and local taxation including business taxes capital gains employment and payroll estate taxes gifts income taxes and property taxes. To collect the property tax in a fair and consistent manner Piscataway New Jersey tax authorities need to have an objective formula for determining the value of.

Attorney Average Salary In Netherlands 2022 The Complete Guide

Attorney Average Salary In Netherlands 2022 The Complete Guide

Attorney Average Salary In Netherlands 2022 The Complete Guide

Duval School Board Votes 6 1 To Put Property Tax Onto August Ballot Wjct News

Law Career Guide 2022 Salary And Degree Info Gradschoolcenter

Attorney Average Salary In Netherlands 2022 The Complete Guide

![]()

Lawyer Salary Top 10 Law Careers Crush The Lsat 2022

Lawyer Salary Top 10 Law Careers Crush The Lsat 2022

Biglaw Salaries Dwarf The Average Lawyer S Report Says Law360

Real Estate Lawyer Salary Comparably

Average Lawyer Salaries By Field What Do They Make

Attorney Average Salary In Netherlands 2022 The Complete Guide

Annual Income Of Corporate Lawyers Spain 2018 Statista

Attorney Average Salary In South Africa 2022 The Complete Guide

How Much Does A Lawyer Make Guide To Types Of Lawyers Salaries